As together with standard banking institutions, Chime takes weekends and holidays away from. Several apps let an individual borrow money instantly, such as Sawzag plus MoneyLion, although other people provide same- or next-day financing. Of Which mentioned, not all same-day loan programs usually are created equivalent, and some demand high fees or require customers to end up being able to signal upward for a good under one building examining account. Therefore, usually perform your current study before determining about the particular right application regarding your own circumstance. Despite The Truth That cash advance applications typically don’t cost traditional attention, many funds advance applications demand ideas or month to month membership charges that will can include upwards quickly. Whilst funds advance application charges don’t constantly show upwards as curiosity prices, these people may equate to become in a position to higher APRs.

How Speedy Is Usually Every Action Of The Financial Loan Process?

This Specific may become especially correct in case a person have an older device that is usually no longer reinforced by more recent applications since it can limit which usually programs an individual may install plus employ. Klover furthermore provides the particular distinctive opportunity to generate details for particular actions, such as using surveys or watching videos. The Particular more details a person earn, the increased typically the advance an individual may possibly be qualified to end upwards being able to receive. That Will means our own articles, evaluations in inclusion to rankings are reasonable, correct plus trustworthy.

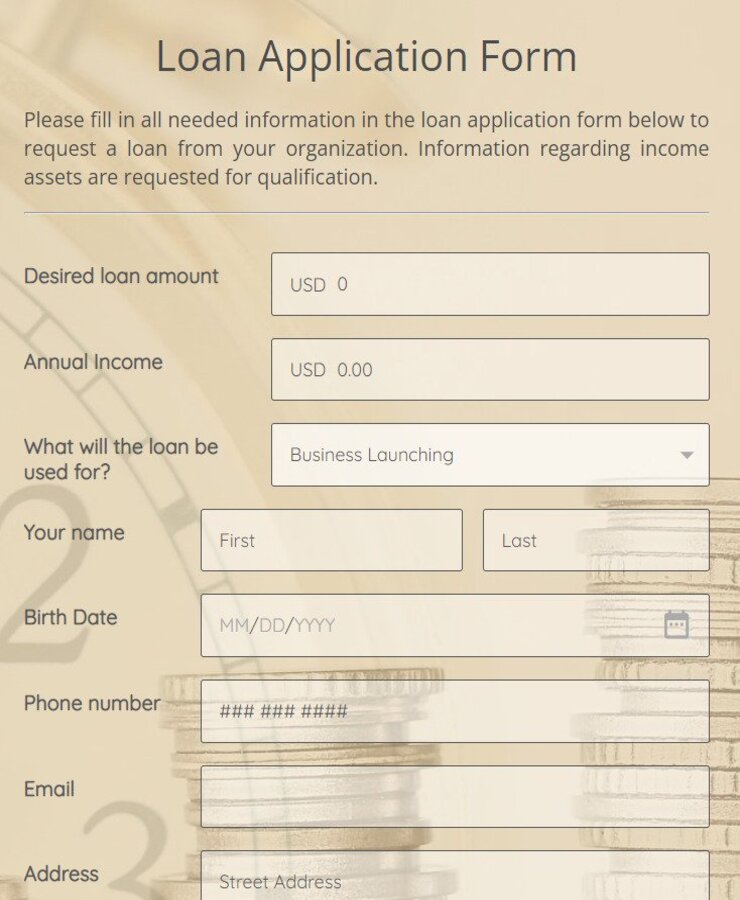

How To Become Able To Choose The Correct Loan Regarding You

- One More easy method in purchase to acquire a $25 quick money advance is usually in buy to make use of Klover.

- An Individual could switch to end upward being in a position to instant $25 mortgage apps to include your self till the next salary.

- In Contrast To most money advance programs that will can be saved straight to your own Google android system, DailyPay relies upon your current company.

- RaShawn Mitchner will be a MarketWatch Guides team mature editor covering personal finance matters plus insurance coverage.

- A co-borrower together with a increased credit rating or income can enhance your own chances associated with qualifying for a private mortgage or getting a much better price.

Super.com is usually a single associated with the particular most adaptable cash advance alternatives away there. In Addition To it may likewise assist you borrow $20 in purchase to borrow cash app $250 against a upcoming income without having having to pay curiosity or invisible fees. Plus it just costs a $1 month-to-month payment to let an individual accessibility ExtraCash Advancements. The Particular app likewise asks for optional ideas in addition to doesn’t demand attention or require a credit score check.

In Case you need a tiny quantity associated with cash to include gas or one more obtain, these types of apps can be a speedy in inclusion to effortless way to entry financing. Nevertheless it’s essential to become able to think about the price of making use of these sorts of programs in contrast to end up being in a position to additional financing alternatives, just like a private financial loan or a credit score card. Some programs do demand unique costs, such as a membership fee or additional charges regarding faster money.

Dave offers a feature known as, Dave ExtraCash, that will allows you to obtain up to $500 immediately together with zero curiosity, credit score bank checks, or late costs. By Simply having a cash advance about your current paycheck, you may prevent having to pay late charges from overlooked repayments any time your own lender stability will be also reduced. ONE@Work, earlier known as Even, is an employer-sponsored economic application of which provides free of charge advances on wages an individual’ve already gained by means of their Instapay feature. As lengthy as your company has set up Instapay as a good employee benefit, it’s free to obtain quick advances. Normally, an individual may have got to be in a position to wait extended or pay a charge to obtain a good immediate advance.

Find Loans

- Funds advance applications may assist buyers stay away from overdraft costs and cover small, unexpected expenses—but they’re just a bandaid, not really a long expression solution.

- In Case you pick to cancel, there’s no obligation to repay the advance, but you’ll require to end upwards being in a position to repay in case an individual need accessibility to cash improvements in typically the future.

- As component associated with its solutions, the particular platform gives funds advancements upward to $500.

- With Earnin, an individual can accessibility upwards to $100 each day plus up to $750 for each pay period of time with out worrying concerning charges or attention fees.

Just Like most funds advance programs for Google android, your current first borrowing reduce will end up being lower. Most fresh users will start at $25 however you’ll get entry to be able to between $50 plus $500 right away when MoneyLion detects recurring debris. It’s generally with respect to a little amount associated with funds, together with a repayment time frame measured in days, not weeks. Becoming a great advance indicates that it’s various coming from conventional installment loans. In Inclusion To while several market as “instant cash” – debris usually take upwards in order to several days with regard to zero demand. An Individual might need in buy to pay an fee additional for a great quick money advance support that offers instant money or exact same day time funds.

How Much Will Do A Money Advance Cost?

Earned income access firms take up to become in a position to a pair of days to provide money, which often will be upon par together with money advance apps. Klover gives a cash advance dependent upon bank bank account membership plus one more based about participation within its factors program. The Particular details program requires customers to become in a position to add receipts, consider surveys plus enjoy video clips in exchange regarding details, which often translate to money customers can acquire as improvements or to end upwards being able to protect fees. Higher fast money costs plus typically the numerous actions to having a tiny advance can make it a less-than-ideal fast-cash option. The fast-funding fee is usually reduced in comparison to be in a position to additional apps, in inclusion to EarnIn doesn’t charge any required costs.

- The system enables customers to borrow up to end upwards being capable to $200, subject to end upwards being capable to availability.

- However, a few applications cost interest, therefore you want in buy to consider the time to become in a position to realize just what you will have got to pay back again.

- Upwards in buy to $1,500 each day each pay period of time could become transferred to an account or charge card.

- FDIC insurance policy up in buy to $250,500 only addresses the particular disappointment regarding an FDIC-insured lender.

- Like the the greater part of cash advance programs for Android os, your preliminary borrowing reduce will become lower.

#10 – Gerald: Funds Out There 50 Percent Your Paycheck Early On

Several income advance apps are developed with respect to new-to-credit customers in inclusion to individuals rebuilding their credit rating with regard to 1 purpose or another. The Particular finest options offer products in addition to solutions to end up being in a position to assist, including credit-builder loans, secured credit cards, plus free of charge credit score scores. The Dork application allows a person borrow a tiny quantity associated with money in buy to cover expenditures whilst an individual hold out regarding your own following paycheck or in purchase to avoid overdrawing your bank accounts. Dave charges high quickly funding fees in comparison in order to additional money advance apps plus the borrowing method is usually even more complicated compared to other apps’. A Few employers may possibly offer you money advances on gained wages via a payroll service. Often even though, you’ll usually require to work together with a third-party support.

0 Comments for “Being Unfaithful Finest Money Advance Applications In Buy To Cover A Person Till Payday”