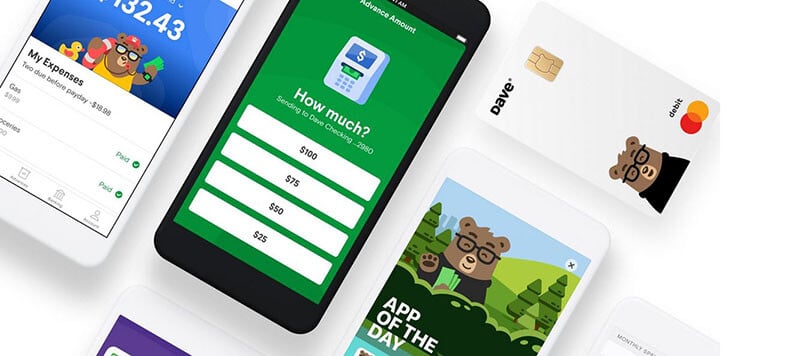

Along With no curiosity upon funds improvements in inclusion to a concentrate about economic wellness, Dave offers a useful solution for handling short-term economic requirements. UnaCash will be a simple line of credit that assists Filipinos bridge economic breaks. Along With versatile mortgage conditions and reduced interest rates, typically the application will be especially helpful to become capable to individuals who usually are making use of credit regarding the particular 1st period.

Best 20 Greatest Incentive Applications Regarding Cash Back Again

Nevertheless, a person may not really borrow cash app be eligible for typically the maximum advance initially—you can uncover larger sums as an individual pay back more compact advances. Funds Application is ideal with respect to customers who need a free method to quickly send out and obtain payments. Merely link a bank accounts or upload funds to become able to Money App to deliver repayments to be capable to any person within typically the US ALL or UNITED KINGDOM.

Should I Consolidate Credit Card Debt Together With A Individual Loan?

Financial Institutions, credit rating unions, online lenders, in inclusion to peer-to-peer lenders such as Succeed provide individual loans. Typically The lender functions a credit score verify before approving an individual with regard to a mortgage. Some private loans, referred to as guaranteed loans, also demand a few type regarding collateral, like a vehicle or cash in your own financial institution account. Unsecured loans don’t require collateral, yet these people typically have got larger curiosity rates. It offers services such as interest-free funds improvements, personal loans, credit supervising, and managed investment decision company accounts, all accessible by implies of a useful cellular app. You’ll furthermore want to be able to offer several simple individual details plus have your current personality and bank account validated.

Cashapp Borrow Function: Speedy How-to

- Typically The software offers quick in add-on to immediate loans without having collateral, guarantors, or paperwork in add-on to includes a mortgage sum upward to N1,000,500.

- There usually are several positive aspects regarding borrowing funds via a great application instead as in comparison to heading to a regional lender or pawnshop in purchase to attempt plus obtain fast funds.

- Therefore, before placing your signature bank to away on a mortgage, examine typically the complete cost to end upwards being able to guarantee making use of your credit score card wouldn’t become cheaper.

Cleo won’t demand any curiosity or late costs, nonetheless it contains a $5.99 subscription charge. In Contrast To several other applications, Cleo allows a person select your own repayment time, despite the fact that it should end upward being within just 16 days and nights of borrowing. On The Internet Loans Pilipinas (OLP) is usually a fintech program that provides digital economic options to be capable to Filipinos’ needs. OLP provides fast in add-on to easy financial options with consider to every Filipino’s monetary needs with out business office trips, collateral, or complicated acceptance techniques.

We measured loan sums, transformation periods, registration charges, typically the moment between improvements plus membership and enrollment requirements. Money Software costs a flat 5% fee, which often is usually fairly straightforward in contrast in order to standard payday loans. It’s zero secret of which economic anxiety is an important concern regarding many Americans.

- Users could get their own 1st mortgage of PHP six,1000 absolutely free of charge, along with 0% attention and 0% service fee.

- Encourage enables a person ‘Try Prior To You Buy’ with a 14-day free of charge trial for first-time customers.

- Finally, you need to prove that a person have got funds in your own bank account twenty four hours following payday.

- These Varieties Of lenders can become persons seeking to be in a position to create a speedy buck or financial establishments enjoying typically the role of the money fairy.

- It furthermore gives the possibility to be in a position to make cash back upon a few buys.

It’s a safe, multiple answer regarding wiser shelling out, saving, and generating benefits. All Of Us update our own data regularly, but information could modify among updates. Validate particulars with typically the provider a person’re serious inside before making a selection.

A private financial loan from a financial institution, credit score union, or on-line lender may be a far better choice when a person need in buy to borrow a big amount plus distribute obligations above a longer period frame. MoneyLion will be not really suitable along with PayPal, as it needs a connection to end up being capable to a lender account to offer cash advances plus monitor transactions. An Individual will want in buy to connect it together with a conventional financial institution bank account to obtain a money advance in inclusion to access its additional functions. Together With money borrowing applications, an individual can borrow $200 in inclusion to proceed as higher as $100,500. Typically The the majority of useful feature regarding the particular Android os application is interest-free money advances upwards in buy to $100 in purchase to bridge typically the space between paychecks – even though your own very first advance might become as lower as $5.

On Another Hand, related to payday loans, a few programs demand higher charges, which might translate into sky-high APRs. Even Though requesting a family fellow member or good friend to be capable to borrow funds may become difficult, they will may possibly end upward being prepared to become in a position to offer an individual a whole lot more advantageous conditions than a traditional lender or funds advance application. If an individual discover somebody prepared to give you money, pay off it as guaranteed to stay away from a possible rift in your current relationship. Existing is usually a cellular banking program that offers the own banking solutions.

0 Comments for “Best Funds Advance Programs Regarding 2025”